INTERNATIONAL: U.S. stocks fell on Wednesday (March 30), with the Dow and S&P 500 snapping four-session winning streaks, on warning signs of progress for peace talks between Ukraine and Russia against a backdrop of a hawkish Federal Reserve curbing economic growth.

Russian forces bombarded the outskirts of Kyiv and a besieged city in northern Ukraine, a day after promising to scale down operations.

The S&P has rebounded more than 5% in March after starting the year with two straight monthly declines. Still, the benchmark index is on track for its first quarterly decline since the first quarter of 2020, when the COVID-19 pandemic in the United States was reaching full swing.

Wells Fargo Investment Institute, Senior Global Market Strategist, Scott Wren:

“As far as the market today, we've had a big rally over the course of the last couple of weeks, really even just shorter than that, I think there are still plenty of uncertainties out there, whether it's Ukraine - Russia, whether it's what the Federal Reserve will do. So, this is just a day where people are taking a little bit of money off the table, traders in particular, after we've had this big jump higher.”

Wells Fargo Investment Institute, Senior Global Market Strategist, Scott Wren:

“We have a 4800 target for the S&P 500 at year end. So, we've had a big run. If we shop around in here a little bit, maybe pull back a little, I don't think that would be a big surprise. The market's trying to figure out what's going to happen with the Federal Reserve, what is Putin going to do next, where's the price of oil. So, I think while that uncertainty remains, we're going to see the market back and forth. Another pullback is certainly likely. But, at the same time, we think there are a few positives out there, whether it's consumer spending or employment that, you know, should keep the market from dropping a lot from here. We still consider pullbacks to be buying opportunities for people that have 12, 24, 36 months plus time horizons.”

“Are we going to slow down? Yes. Is the probability of a recession higher than it was a few months ago? Yes. But as far as we're concerned, Europe may dip into recession in 2022 or into early 2023. But as far as the U.S. goes, we certainly don't think we're going to see a recession this year.”

“The way that Russia - Ukraine war is going to affect the market, at least in our opinion, is through the price of oil. So, if oil trades higher, if, for instance, the supply of oil into Europe is cut off or dramatically reduced, the stock market's probably not going to like that. So, for us, right now, even though it's very hard to predict what Putin might do, the effect immediately in the financial market is going to be through oil. Higher oil prices cut into consumer spending. Consumers have less money to spend, that slows the economy.”

“Well, as far as the yield curve inversion goes, investors, they know that before recessions, before the last number of recessions, the yield curve has inverted. And so, while it's not written in stone that we're going to have a recession, certainly the last ones have been preceded by an inversion of the curve. And I think that's why the yield curve garners so much attention, especially when the economy starts to slow down, and the Federal Reserve is in a rate hiking mode.”

Stock prices have been sensitive to headlines about any progress for a deal to resolve Russia's invasion of Ukraine. Already-high U.S. inflation has intensified with surging commodity prices such as oil and metals since the war began.

"Even though it's very hard to predict what Putin might do, the effect immediately in the financial market is going to be through oil. Higher oil prices cut into consumer spending. Consumers have less money to spend, that slows the economy," said Scott Wren, Senior Global Market Strategist, Wells Fargo Investment Institute, in St. Louise, Missouri.

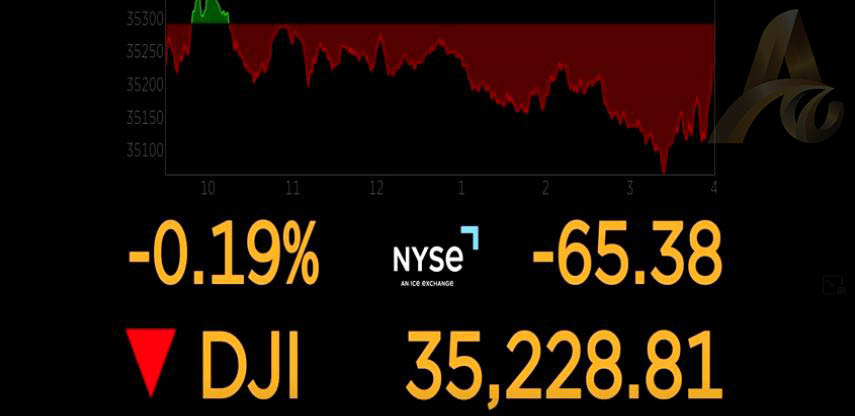

According to preliminary data, the S&P 500 lost 29.86 points, or 0.64%, to end at 4,601.74 points, while the Nasdaq Composite lost 177.48 points, or 1.21%, to 14,442.15.

The Dow Jones Industrial Average fell 63.14 points, or 0.18%, to 35,231.05.

PHOTO: NEW YORK STOCK EXCHANGE (NYSE) CLOSING BELL, DOW JONES INDUSTRIAL AVERAGE CLOSING BOARD, COMMENTS FROM WELLS FARGO INVESTMENT INSTITUTE, SENIOR GLOBAL MARKET STRATEGIST, SCOTT WREN.